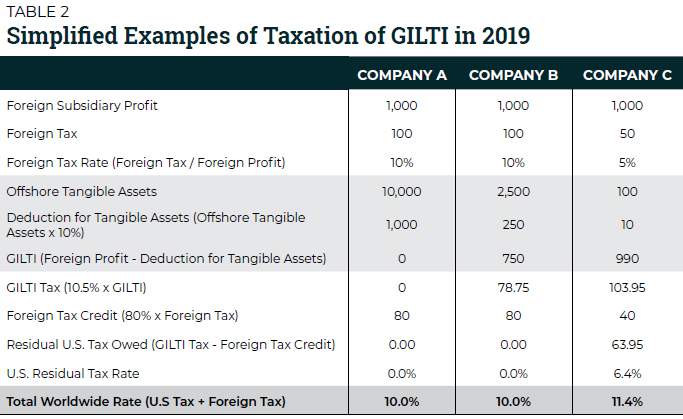

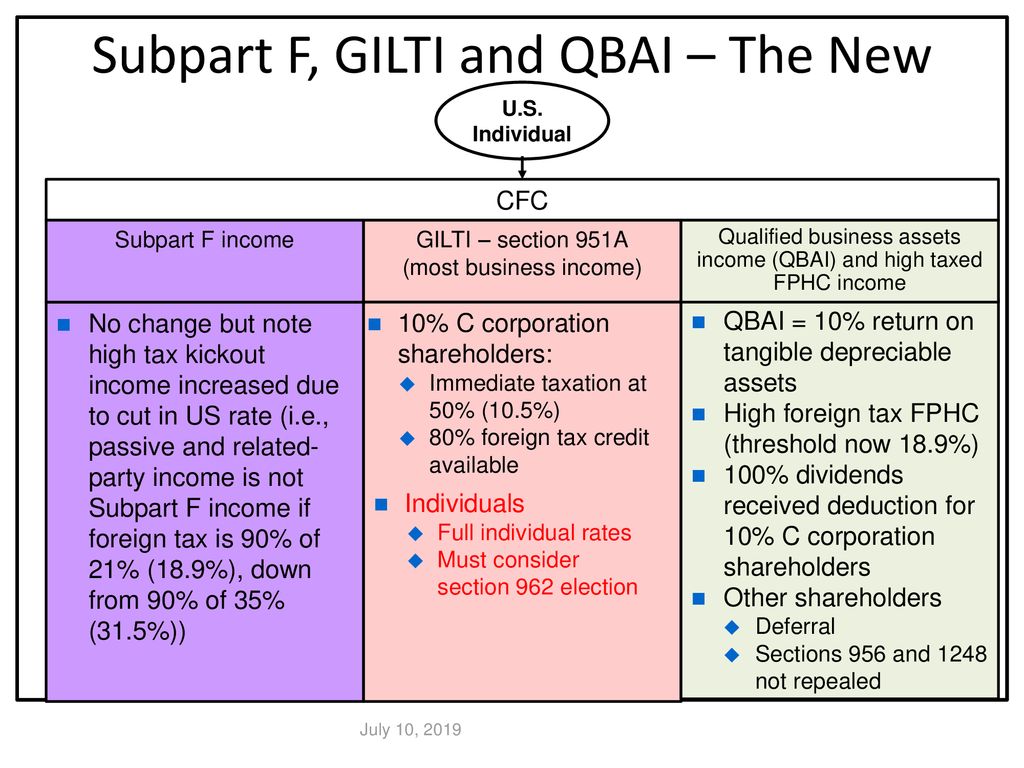

Section 962 Election of The Corporate Tax Rate by Individuals, Trusts and Estates For Global Intangible Low-Taxed Income (GILTI) Income Inclusions Thomas. - ppt download

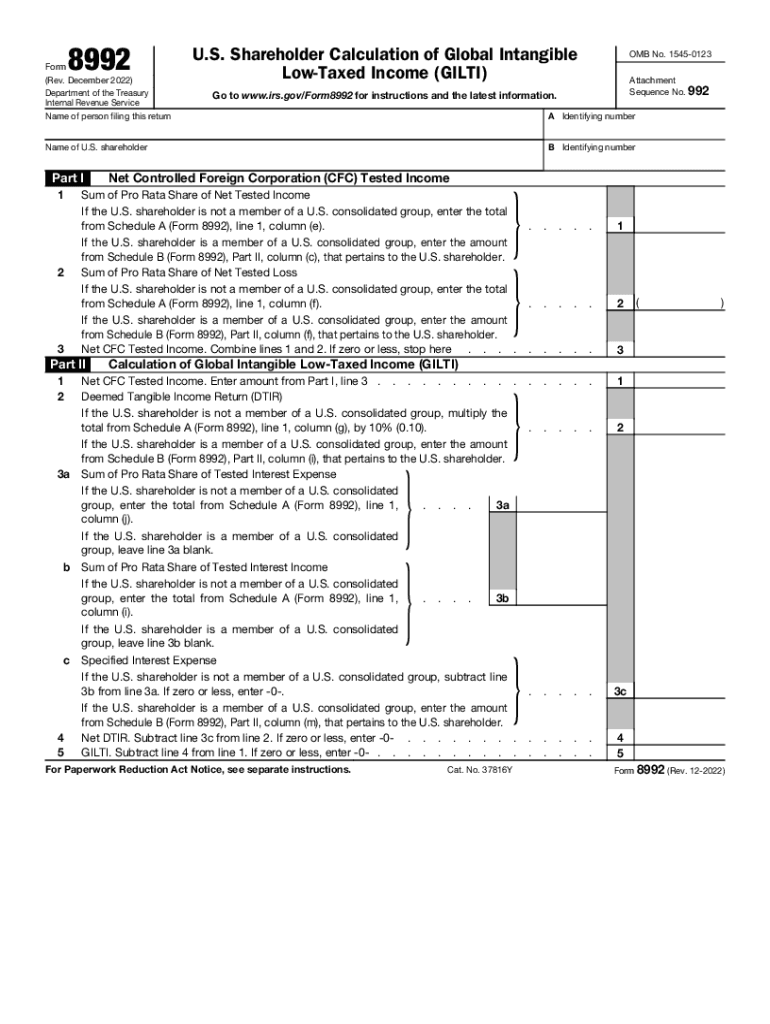

Primer plano del título del Formulario 8992, cálculo de los ingresos intangibles bajos gravados (GILTI) por parte de los accionistas de los Estados Unidos Fotografía de stock - Alamy

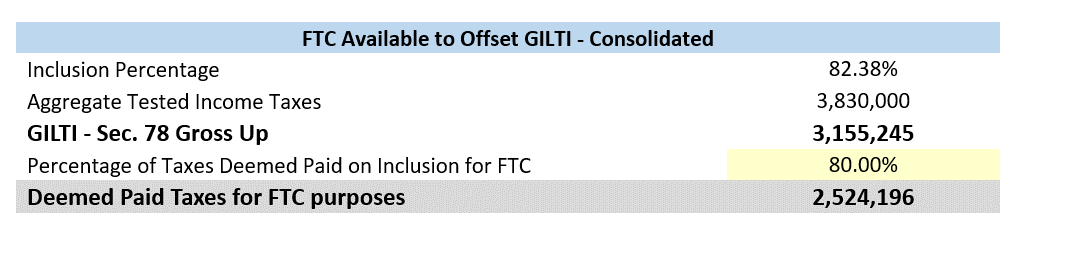

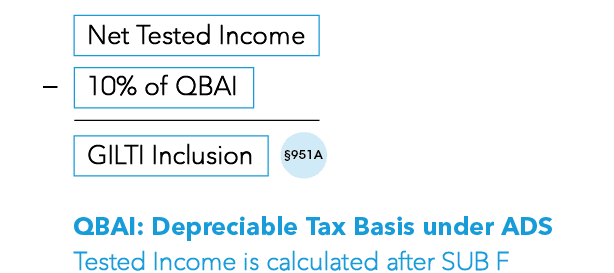

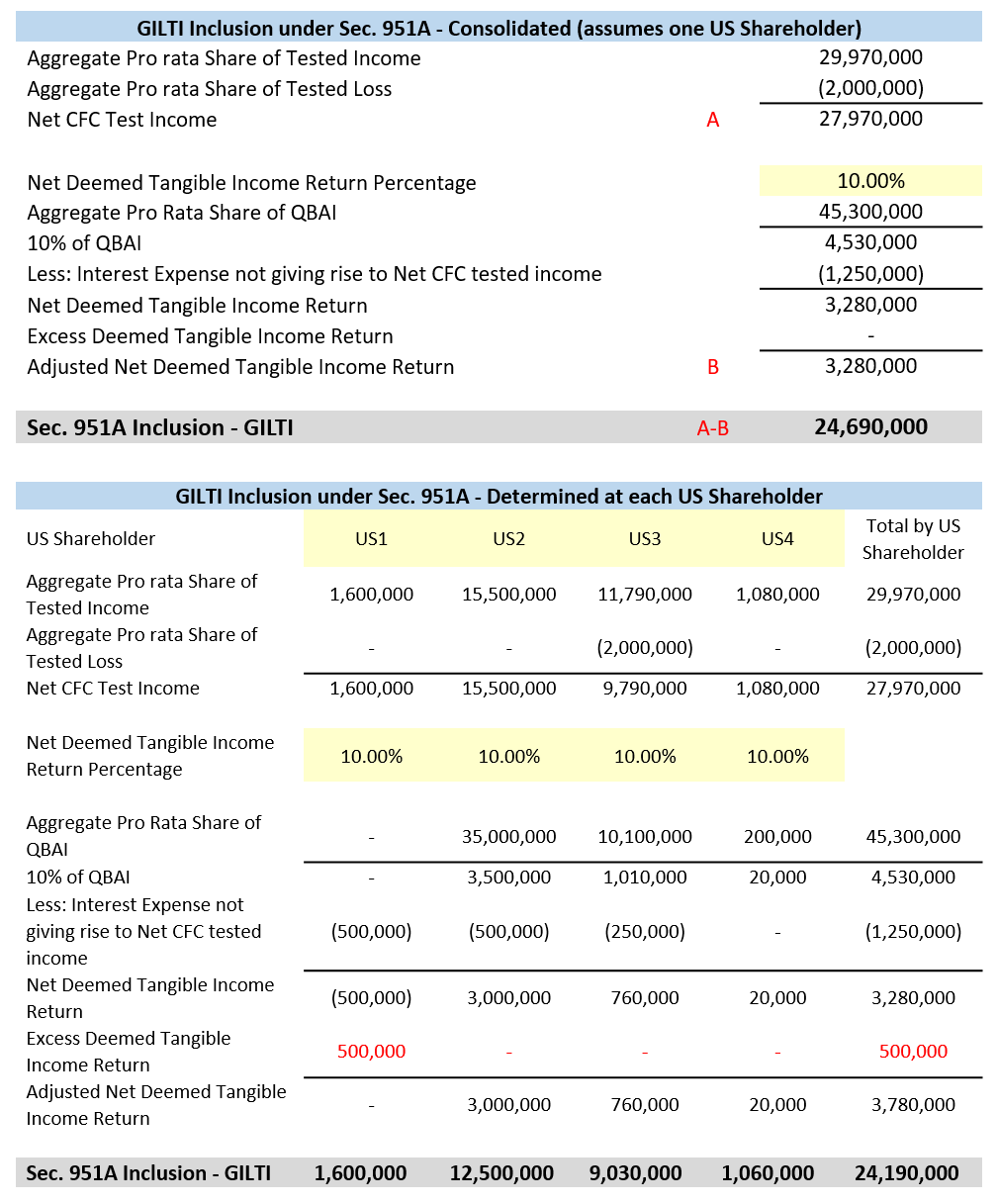

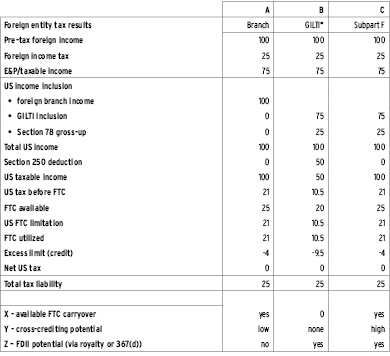

Understanding How to Compute a U.S. shareholder's GILTI inclusion | Foodman CPAs & Advisors - JDSupra

Understanding How to Compute a U.S. shareholder's GILTI inclusion | Foodman CPAs & Advisors - JDSupra

Primer plano del título del Formulario 8992, cálculo de los ingresos intangibles bajos gravados (GILTI) por parte de los accionistas de los Estados Unidos. Enfoque selectivo en la palabra GILTI Fotografía de